Time Management: Bullet Journaling & Habit Tracking

Each June, when we reach the half-point of the year, I like to reflect on my goals from the start of the year. I consider all that I accomplished in the first half of the year and all that that I plan to accomplish in the second half.

Of course, 2020 has been unlike other years. My plans, like everyone’s, were dramatically altered when the unimaginable global pandemic swept in. I did not set aside time in June to do my annual half-point review, because to be honest, I was catching my breath as the (unplanned home) school year closed. I will write more about how the pandemic has effected my life and my goals for 2020 soon. But today, I would like to do an update regarding just one of my goals: my goal to practice bullet journaling and habit tracking.

I have been wanting to track my habits for years. I’ve known for awhile that tracking habits is a powerful tool to improve your life. I finally decided that 2020 would be the year that I began to do it and I am so hooked. Even though 2020 has been awful in many ways, it has also been amazing for me personally in many respects. When it comes to my overall wellness, productivity and joy–I am truly in the best place I have ever been in my life.

Why Should You Track Your Habits?

I have become obsessed with my habits and it’s awesome. Why? Because my habits determine my life! As Aristotle said, “We are what we do repeatedly. Excellence then is not an act, but a habit.” Tracking habits makes remembering and following all your patterns easier in the long term. If you track your habits, you have a written record to review so that you can see where you are succeeding and where you are falling short. This information is invaluable in terms of holding yourself accountable and leading the life that you wish for.

Another benefit of habit tracking is that the practice itself serves as a reminder of what you want to be doing. For example, when it is getting near to the end of the day if I haven’t done my 20 minutes of writing for the day I will think about how I will feel when I am not able to mark that off as “completed for the day” in my habit tracker. I will feel disappointed. So, often, I will make sure to squeeze in those 20 minutes of writing just because I know how gratified I will feel upon marking it off as completed for the day. This holds true, not just for my 20 minutes of writing, but for all of the daily habits that I track.

The last benefit that I want to discuss is the incredible way that habit tracking can impact your mindset. I update my habit tracker each morning and I check off the habits that I completed on the previous day. This practice does so much for mindset because it allows me to mentally review everything that I accomplished yesterday and it reminds me of everything that I want to accomplish today. It sets me up for success by reminding me of everything that I want to do and be each day. This practice is a wonderful way to cultivate mindfulness.

How to Track Your Habits

When it comes to tracking your habits, there are so many ways that you can do it. You can purchase a habit tracker journal; you can use an app; or you can use a blank bullet journal which is what I do. But even if you have nothing other than a piece of paper and a pencil, you can still track your habits. It really doesn’t require anything fancy. Here are the basic steps.

1. Decide which habits you want to track.

Take some time to reflect on your current habits and on the habits that you would like to start incorporating into your routine. Your habits can be anything, from basics like brushing your teeth twice a day, to complex habits like implementing a yoga routine, and even to eliminating habits like eating processed chocolate for example. The important thing is that your habits are doable and measurable. For example, “no chocolate” is a good, doable, measurable habit; while “eat healthy” is probably too broad.

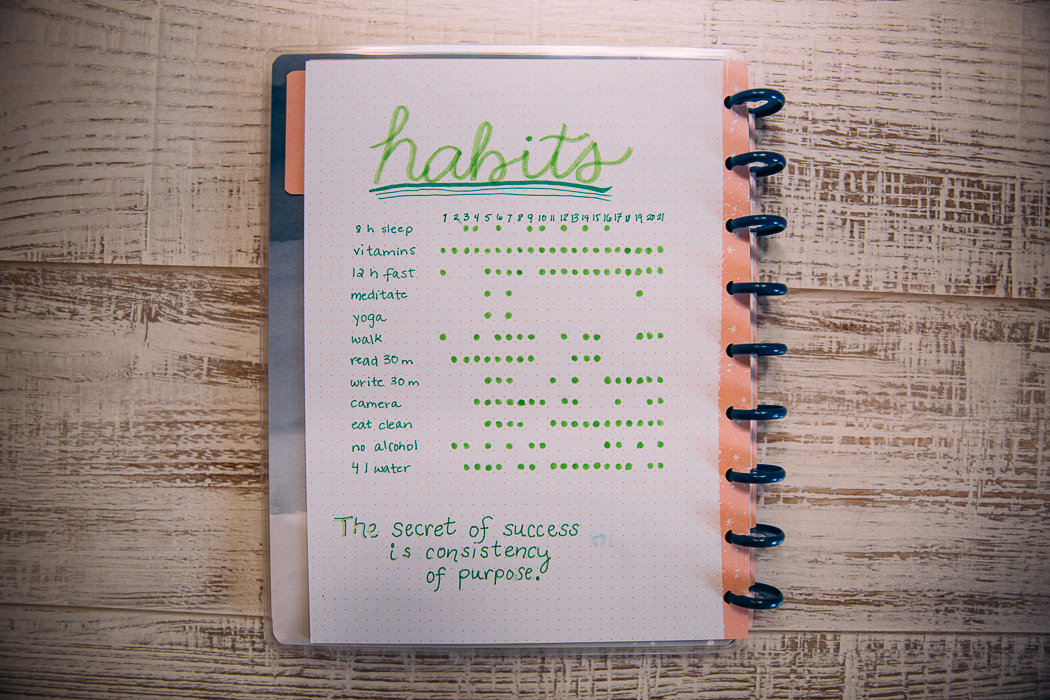

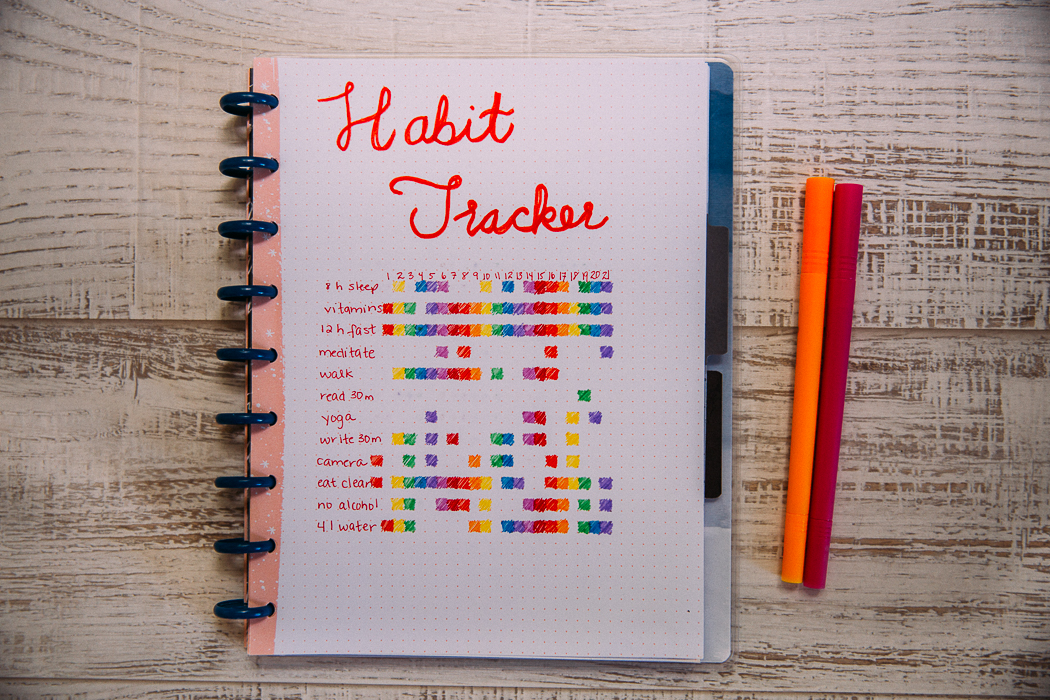

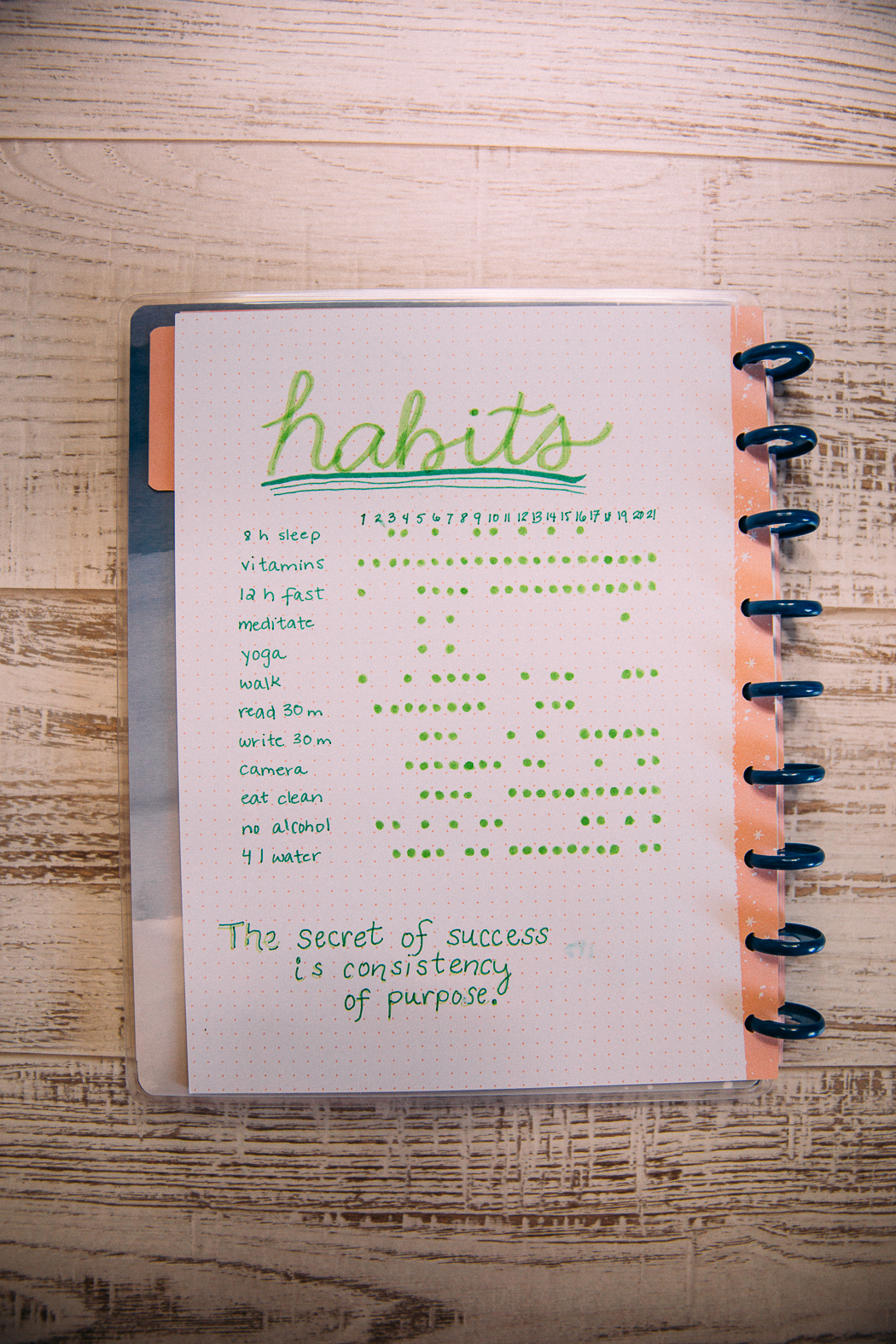

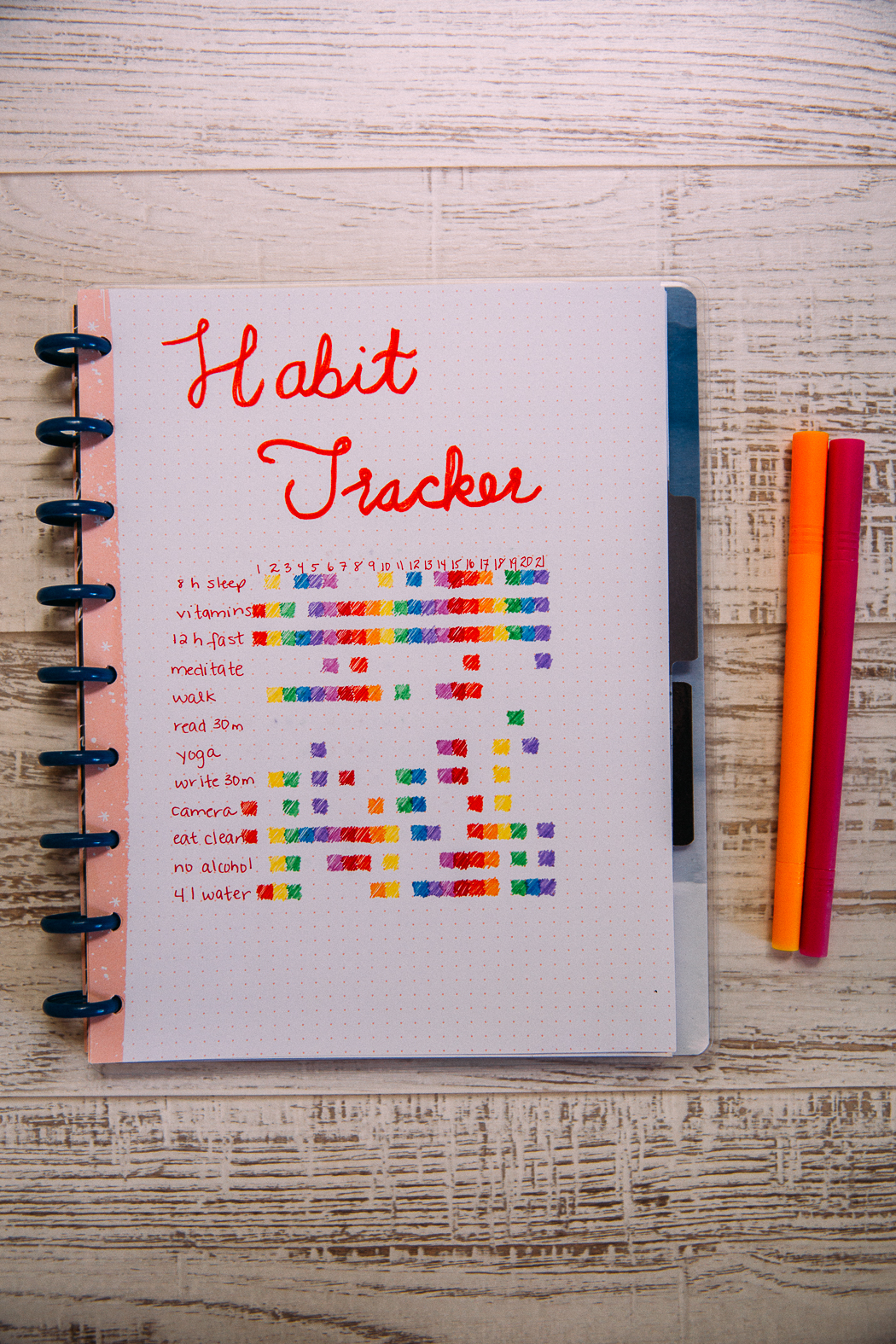

To give you some ideas, let me share the habits that I am currently tracking.

8 hours sleep

12 hour fast – I fast each day from about 6 pm to about 11 am but I try for a minimum of 12 hours

walk – I like to get outside for a walk each day, whether long or short fresh air restores me

vitamins – I take a few vitamins each day to supplement my diet

no alcohol – I try to avoid drinking alcohol most days

eat home – I am making a big effort to eat out as infrequently as possible

4 liters water – I try to drink a minimum of 4 liters of water each day (I fill this water bottle twice each day)

meditate – I have yet to incorporate a daily meditation practice, but want to

yoga – due to the pandemic my yoga classes have been cancelled, I still want to implement an at-home practice but I’m not there yet

camera – I have a goal to use my DSLR camera each day, although presently it’s more like once a week

read 20 minutes

write 20 minutes

clean 20 minutes

If you look over my habit tracking results, you will see that in some areas I do incredibly well and other areas, not so much. This leads me to my next point.

2. Give yourself grace.

One of the most important elements of habit tracking is remembering to give yourself grace. Habit tracking should not be used as a method for punishing yourself or beating yourself up. Remember that if you do not succeed in a particular habit today, this should serve as an inspiration for how you can do better tomorrow.

As you can see by looking at my results, at times entire weeks go by where I make zero progress in certain areas. I do not get discouraged by this information, instead I recognize that I need to make some major shifts in my life to empower and enable myself to progress in those areas. A good example of this is yoga. Just before the pandemic hit I was getting back on track with attending yoga classes twice each week. When my studio shut down, my practice went to the wayside. Even though I have failed at consistently implementing an at-home routine thus far, I keep yoga on my habit list because I know that making it a daily practice will dramatically improve my life. I need to get over the self-limiting beliefs that are holding me back, and I will.

3. Adjust as needed.

With that being said, do not be afraid to adjust. If there is a particular habit that is no longer serving you well, feel free to remove it from your habit tracker altogether. Likewise, do not be afraid to make additions. As you may have seen, the earliest incarnations of my trackers did not include daily cleaning, but my current tracker does. Housekeeping has climbed on my personal priority list, so a daily minimum of 20 minutes of cleaning each day naturally made its way into my habit tracker.

4. Hold yourself accountable. As I mentioned above, it is important to give yourself grace, but it is also important to gracefully hold yourself accountable. You can track your habits with a partner or share your results publicly. It can also help to share your habit tracking with a licensed therapist. Visit https://www.betterhelp.com/

So that is it, my friends. Those are the basics for habit tracking and the reasons why you might want to start. If you have any questions about my process, I would be happy to answer them. Also, if you have any other great methods for tracking your habits that I haven’t touched on, I’d love to hear them!