You can do anything. But you can’t do everything.

“How did I end up here, again?” I asked myself, lying on my back in the emergency room hospital bed a couple of weeks ago. It was the second time in as many years that I found myself in that very position.

Recently a friend told me that I try to do too much, that I need to listen to my body. And since then, I’ve been doing just that.

It’s not easy for me. I am programmed to go and go, to do and do, until I literally drop. Many things come natural to me, relaxation is not one of them. In fact, I can’t relax. When I try to, my mind races and I get up and do something. When I try to go to sleep at night, I can’t turn my brain off and sometimes I resort to taking medicine just to get to sleep.

I know, however, that it’s not healthy. I know that even though this is my season of building and growing, that I cannot grow anything beautiful if my tank is empty.

In the last two weeks I have done less than I have in a very long time. And more importantly I am proud of that fact. In this world of do, do, do -and- go, go, go. I have decided to do less.

I will do less, but I will do everything with intention.

I love lists and I’ve implemented a new daily/weekly/monthly list system that has been working really well for me. I use a simple spiral bound notebook. Technology is wonderful but writing these lists out and physically crossing items off of them is great for my soul.

I start with a weekly to-do list. It is usually quite long and a little overwhelming but I don’t focus on it too much. It is a starting point and it helps to feed my more manageable daily to-do lists.

I have a separate page to keep my daily to-do “short lists.” I choose the 5 to 7 most important things from the weekly list for my daily lists. As I move through my day, I cross items off the list as they are completed. It gives me joy and momentum to look back at my lists and see so many things crossed off.

Sometimes when I am feeling overwhelmed I even add little things to the list like washing dishes or giving the kids a bath. This simple practice lets me experience the joy of crossing these mundane tasks off the list when they are finished.

At the end of the day and week, when I look back at all that I have accomplished, I feel deeply fulfilled and proud. It is so easy to beat myself up and feel that “I never do enough.” But when I am able to physically look at what I accomplish in a day or a week, it’s pretty incredible!

Another really important thing about my lists, is that while they keep me on task, I also give myself complete grace to complete or not complete any item on the list in a particular day. I don’t get everything done on my lists — and that is completely okay! It is so important to give myself that grace otherwise my lists will just become another means for me to come down on myself. Instead of that, I simply move unfinished items to the next day or even back over to my weekly list to be completed at a later time. The key is to focus on what I do accomplish.

This practice has also given me incredible insight into what is realistic. I have learned that I tend to really overshoot when it comes to setting goals. I had originally set a goal to make 3-5 blog posts a week in 2018. After starting this practice, I recognize that this is not realistic given my current responsibilities. It feels so good to be able to see that and adjust my plans instead of beating myself up for “not hitting the mark.”

I do what I can and when something doesn’t get done, I say, “It will get done when it gets done.” PERIOD. END OF STATEMENT.

It’s in my nature to feel not good enough. For my entire life I have been apt to negative self talk. Sometimes I have even called myself lazy. When I think about that now it is absolutely ridiculous, but the mind is so powerful and mine has a tendency to float right toward negativity if I don’t keep it in check.

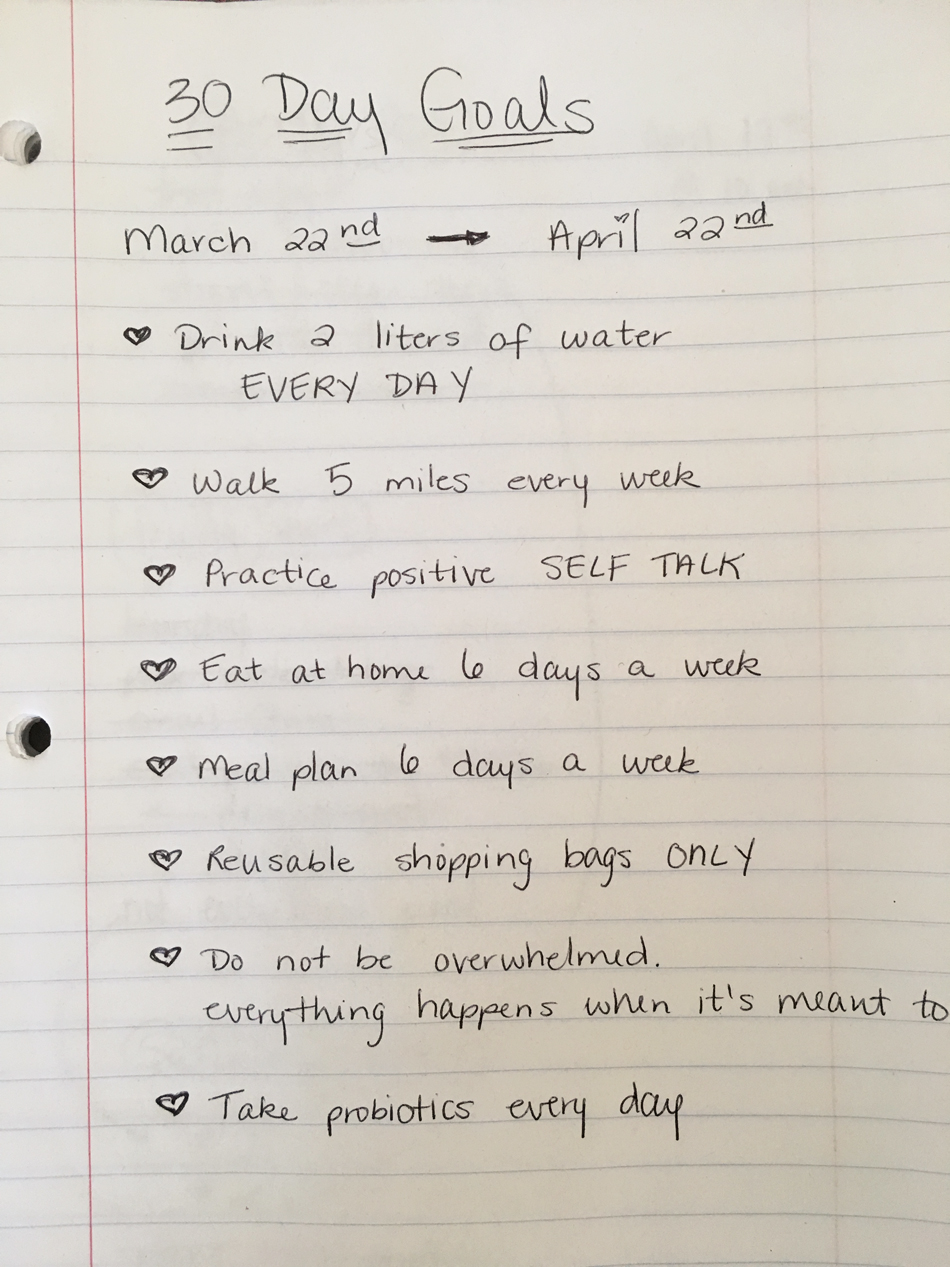

Finally, in addition to my daily and weekly to-do list I have a 30-day goal list. This list has no more than 10 items and lists some of my big picture goals for the month. These are things that I want to do every single day and reading over this list each morning puts me in a positive, productive state of mind. It’s like a compass that points me in the right direction as I start each day.

While all of this sounds pretty practical, it hasn’t been easy coming to this point. The truth is that my anxiety & depression had gotten pretty out of control again recently. I have been climbing out of that darkness and for the first time in awhile, I feel like I am in a good place. I am a person who thrives on stability, creativity, and productivity.

Implementing this list practice has allowed me to get back on track and I am grateful for it. For me, this is so much more than organization. This is about wellness, health, and happiness.

Awhile ago, I read this quote: You can do anything, but you can’t do everything. It struck me deeply then, but only now am I ready to truly embrace its meaning and live it.

I love this post – thank you for sharing. I just found your blog by searching “women’s inspirational blog” and I have certainly felt inspired. I’m a list maker, too. I’m in the middle of a major life change right now (we are pregnant with our third, a little sooner than we thought we’d be) and have been beating up on myself SO MUCH about not getting enough done. But this is challenging me to reevaluate that – my enough just looks different right now, because I can’t do everything. <3

Thank you so much for stopping by and for leaving a comment. I am so pleased to meet you. I am so happy to hear that you are now challenged to stop beating yourself up so much. We are all in this together, Mama!! xoxo